Deciphering Economic Shifts: Navigating Inflation Rate Trends

In the intricate landscape of economics, understanding and adapting to inflation rate trends are critical for individuals, businesses, and policymakers. This article delves into the dynamics of inflation and provides insights into strategies for navigating its trends.

The Essence of Inflation

At its core, inflation signifies the rise in the general price level of goods and services over time. This economic phenomenon impacts the purchasing power of money, influencing consumer behavior, investment decisions, and overall economic stability.

Key Influencing Factors on Inflation Trends

A myriad of factors contributes to inflation, ranging from demand-pull forces generated by increased consumer demand to cost-push factors resulting from rising production expenses. Delving into these factors is essential for predicting and understanding the trajectory of inflation.

Central Banks as Guardians of Inflation

Central banks play a pivotal role in managing inflation. Through tools like interest rates and open market operations, they aim to keep inflation within a targeted range. An exploration of these strategies provides valuable insights into the economic health of a nation.

Global Forces Shaping Inflation

In today’s interconnected global economy, international events and trends significantly impact inflation rates. Fluctuations in commodity prices, shifts in currency values, and geopolitical developments can reverberate globally, influencing local inflation dynamics.

Inflation’s Impact on Consumers

For individuals, inflation directly influences their purchasing power. Understanding how inflation affects the cost of living is crucial for making informed financial decisions. From budgeting to investment choices, consumers must navigate a landscape shaped by inflation.

Strategies for Investors in Inflationary Environments

Investors face the challenge of preserving their wealth amidst inflation. Diversification, incorporating inflation-protected securities, and selecting assets with the potential for real returns are strategies employed by astute investors to navigate inflationary periods.

Business Resilience Amidst Inflationary Pressures

Businesses grapple with the impact of inflation on production costs, pricing, and profitability. Effective cost management, strategic pricing adjustments, and optimizing supply chains become imperative strategies for maintaining resilience in inflationary environments.

Government Actions to Mitigate Inflation

Governments employ fiscal policies to mitigate inflationary pressures. Striking a balance between government spending, taxation, and public debt is crucial for creating a stable economic environment. Examining policy decisions provides insights into potential inflation trajectories.

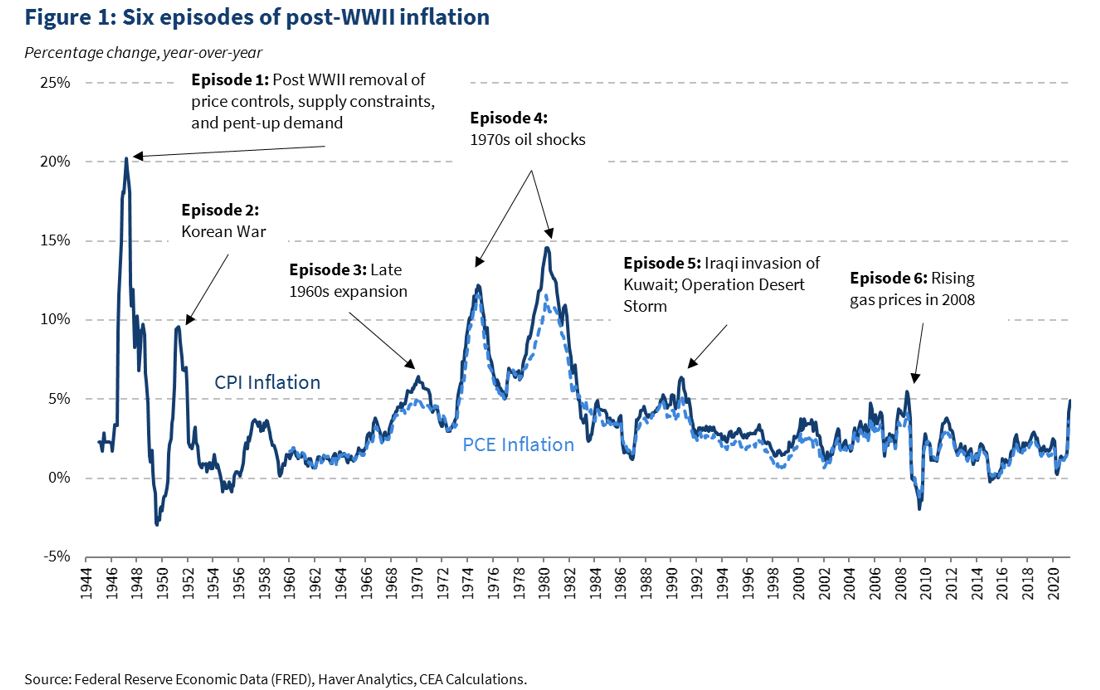

Consumer Price Index (CPI) as an Inflation Barometer

The Consumer Price Index (CPI) serves as a crucial indicator for measuring inflation. By tracking changes in the prices of a basket of goods and services, the CPI provides a snapshot of inflation’s impact on the average consumer, aiding economic analysis.

Adapting Strategies for Individuals and Businesses

As inflation rates fluctuate, individuals and businesses need adaptive strategies. Negotiating contracts with inflation adjustments, considering alternative investments, and adjusting salary structures are examples of strategic adaptations to inflationary pressures.

Navigating Inflation Rate Trends for a Stronger Financial Future

Understanding inflation rate trends is an ongoing process demanding vigilance and adaptability. For further insights and expert analysis on inflation and its impact on the economy, visit keozanara.my.id. Stay informed, make strategic decisions, and navigate the complexities of inflation for a more resilient financial future.