Navigating Global Recession Risks: Strategies for Uncertain Times

In the ever-changing landscape of the global economy, understanding and preparing for recession risks is crucial. Explore effective strategies to navigate through these uncertain times and safeguard your financial well-being.

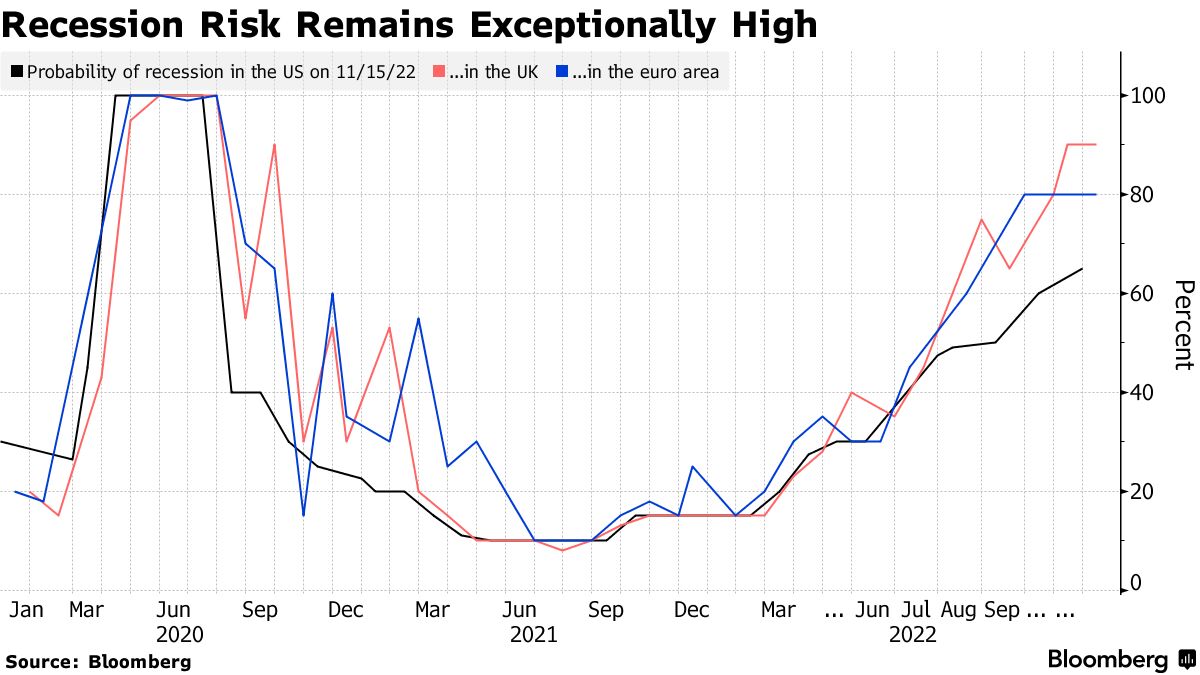

Assessing Economic Indicators

Before delving into recession strategies, it’s essential to stay informed about key economic indicators. Keep an eye on factors like GDP growth, unemployment rates, and consumer spending. A comprehensive understanding of these indicators provides a solid foundation for anticipating and responding to potential recessionary trends.

Diversify Your Investments

Diversification is a timeless strategy that proves invaluable in times of economic uncertainty. Spread your investments across various asset classes such as stocks, bonds, and precious metals. This approach helps mitigate risks and ensures that your portfolio is not overly exposed to the fluctuations of a single market.

Building a Robust Emergency Fund

In times of recession, having a robust emergency fund is a financial lifeline. Aim to set aside three to six months’ worth of living expenses in a liquid and easily accessible account. This fund acts as a cushion, providing financial stability during unexpected job loss or economic downturns.

Evaluate and Adjust Your Budget

Reassessing and adjusting your budget is a proactive measure to weather a potential recession. Identify non-essential expenses that can be trimmed, redirecting resources towards essential needs. This disciplined approach to budgeting ensures that you can adapt to changing economic circumstances while maintaining financial stability.

Explore Defensive Investment Strategies

Consider shifting a portion of your investment portfolio towards defensive assets. Defensive investments, such as utility stocks or government bonds, tend to be more resilient during economic downturns. While these may offer lower returns in robust economies, they can provide stability when recession risks are high.

Stay Informed and Stay Liquid

Maintaining liquidity is key during uncertain economic times. Keep a close eye on market developments, policy changes, and global economic trends. Having liquid assets allows you to take advantage of opportunities or quickly pivot your strategy in response to changing market conditions.

Seek Professional Financial Advice

Navigating a global recession requires a nuanced understanding of economic complexities. Seeking advice from financial professionals can provide personalized insights and strategies tailored to your specific situation. Professionals can help you make informed decisions, ensuring that your financial goals remain on track.

Explore Alternative Income Streams

Diversify your sources of income by exploring alternative streams. This could involve pursuing freelance work, starting a side business, or investing in income-generating assets. A diversified income portfolio can provide additional financial security during economic downturns.

Debt Management and Reduction

Evaluate and manage your existing debt to prepare for a potential recession. High-interest debt can be particularly burdensome during economic downturns. Develop a debt reduction plan, focusing on paying down high-interest loans and avoiding accumulating new debt in uncertain economic climates.

Global Recession Risks: A Call to Action

As the global economic landscape continues to evolve, preparing for recession risks becomes a critical aspect of financial planning. By staying informed, diversifying investments, building a robust emergency fund, and implementing strategic measures, individuals and families can navigate through uncertain times with resilience.

For more insights on handling Global Recession Risks, visit Global Recession Risks.