Introduction:

The current economic landscape has presented consumers with the challenge of rising prices across various sectors. Navigating these increases requires a strategic approach to managing finances and making informed decisions. This article explores effective strategies for individuals and households to cope with rising consumer prices. To delve deeper into navigating economic challenges, visit Rising Consumer Prices.

Understanding the Causes:

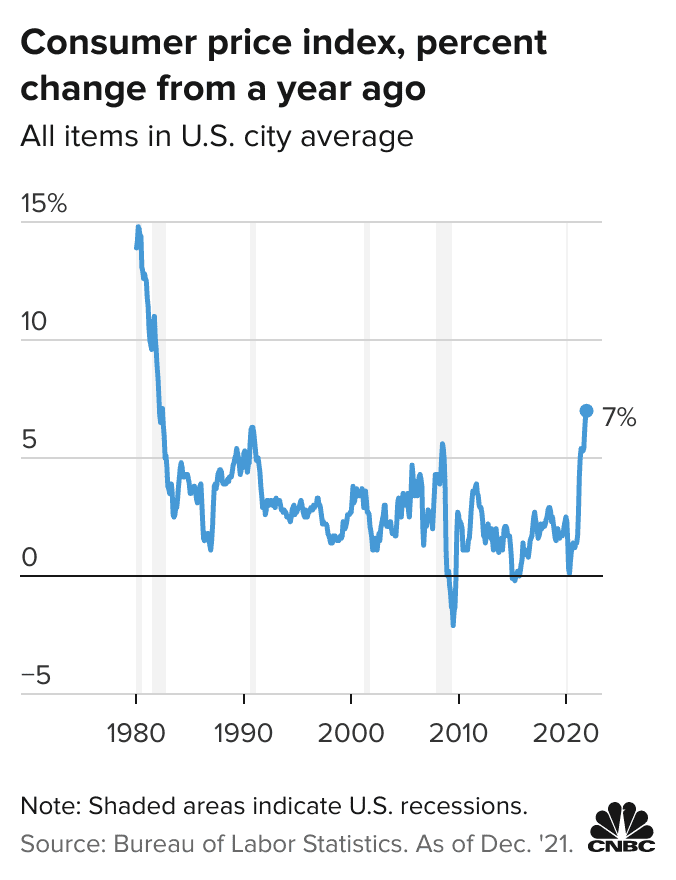

Before implementing strategies to cope with rising consumer prices, it’s essential to understand the underlying causes. Factors such as inflation, supply chain disruptions, and increased demand can contribute to price hikes. By gaining insight into the reasons behind rising prices, individuals can make more informed financial decisions.

Budgeting and Prioritizing Spending:

In times of rising consumer prices, budgeting becomes a crucial tool for financial management. Review and adjust your budget to accommodate increased expenses. Prioritize essential spending, such as housing, utilities, and groceries, while identifying areas where discretionary spending can be temporarily reduced.

Seeking Cost-Saving Alternatives:

Consumers can actively seek cost-saving alternatives without sacrificing quality. Explore generic brands, compare prices across different retailers, and take advantage of sales and promotions. Additionally, consider buying in bulk to benefit from volume discounts and reduce the overall cost per unit.

Evaluating Subscription Services:

As consumer prices rise, it’s advisable to reassess subscription services. Evaluate the value each subscription brings and consider consolidating or canceling services that are not essential. This can free up funds for more immediate needs and help streamline monthly expenses.

Exploring Financial Assistance Programs:

In challenging economic times, individuals may explore available financial assistance programs. Government assistance, community resources, and nonprofit organizations often provide support to those facing financial hardships. Research and inquire about programs that may offer relief or aid in specific circumstances.

Investing in Financial Literacy:

Investing time in financial literacy can empower individuals to make informed decisions about their money. Understanding how to navigate investments, savings accounts, and debt management can contribute to long-term financial stability, even in the face of rising consumer prices.

Negotiating with Service Providers:

Don’t hesitate to negotiate with service providers for better rates or discounts. Whether it’s negotiating your cable bill, insurance premiums, or interest rates on loans, many providers may be willing to work with customers facing financial challenges. A simple conversation can lead to cost savings.

Building an Emergency Fund:

An emergency fund serves as a financial safety net during uncertain times. If rising consumer prices impact your budget, having an emergency fund can help cover unexpected expenses without relying on credit. Aim to build and maintain an emergency fund to enhance financial resilience.

Considering Long-Term Investments:

For individuals with the capacity to do so, considering long-term investments can be a strategic move. Real estate, stocks, and other investment opportunities may provide a hedge against inflation and contribute to building wealth over time. Consult with a financial advisor to explore suitable options.

Engaging in Sustainable Spending Habits:

Sustainable spending involves making mindful choices that align with long-term financial goals. Assess your spending habits, identify areas for improvement, and focus on sustainable practices. By adopting a mindful approach to consumption, individuals can contribute to financial stability and environmental sustainability.

Conclusion:

In conclusion, rising consumer prices present challenges that require a proactive and strategic approach to financial management. To explore more strategies for navigating economic challenges, visit Rising Consumer Prices. By understanding the causes, budgeting effectively, and exploring cost-saving alternatives, individuals can navigate these economic challenges with resilience and financial well-being.