Navigating the UK’s Inflation Challenge: Trends and Implications

In recent times, the United Kingdom has found itself grappling with a complex economic phenomenon – inflation. This pervasive force has a profound impact on various aspects of the nation’s financial landscape. Let’s delve into the key trends and implications of the current UK inflationary environment.

Understanding the Current Inflationary Landscape

To comprehend the challenges posed by inflation, it is imperative to grasp the current state of the UK’s inflationary landscape. Inflation, essentially the rise in the general price level of goods and services, has been a persistent concern, prompting economic analysts to closely monitor its trends.

Factors Driving Inflation in the UK

Several factors contribute to the inflationary pressures witnessed in the UK. From global supply chain disruptions to increased demand for certain goods and services, understanding these drivers is crucial. Additionally, factors such as government policies and international economic conditions play a pivotal role in shaping the inflationary environment.

Impact on Consumer Spending and Budgets

As inflation accelerates, its impact on consumer spending becomes pronounced. Rising prices often lead to a decrease in purchasing power, affecting the average consumer’s ability to maintain their usual spending habits. This, in turn, has implications for household budgets and overall economic stability.

Challenges for Businesses and Industries

Businesses also face challenges in an inflationary environment. The increased costs of raw materials and labor can squeeze profit margins, forcing companies to make strategic adjustments. Navigating these challenges requires adaptability and foresight on the part of businesses across various industries.

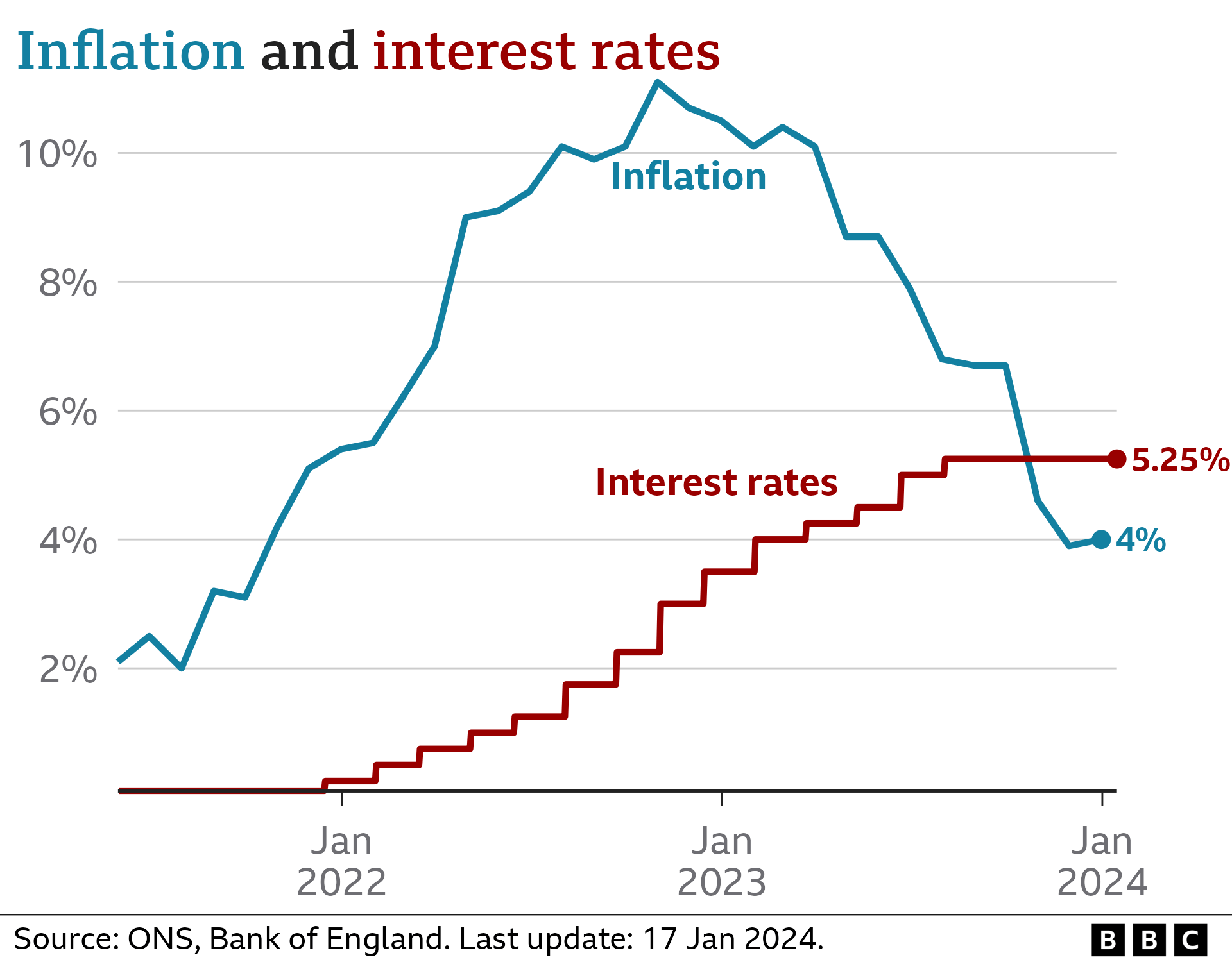

Government Responses and Monetary Policy

Governments play a crucial role in mitigating the effects of inflation. Through fiscal policies and monetary measures, authorities attempt to strike a balance that ensures economic stability. Understanding the strategies employed by the UK government and the Bank of England provides insights into the broader economic landscape.

Investment Strategies in Inflationary Times

For investors, an inflationary environment requires a reevaluation of investment strategies. Certain assets may perform better in such conditions, and diversification becomes a key consideration. Exploring avenues that historically have shown resilience in times of inflation is essential for safeguarding investment portfolios.

The Role of Technology and Innovation

In addressing the challenges posed by inflation, technology and innovation can play a transformative role. Embracing digital solutions, streamlining processes, and adopting efficient technologies can help businesses mitigate the impact of rising costs and enhance overall resilience.

UK Inflationary Environment: A Call to Action

Amidst the complexities of the current inflationary environment, proactive measures are necessary. Businesses, consumers, and policymakers alike must collaborate to find sustainable solutions. By fostering an environment of innovation, adapting to changing market dynamics, and implementing effective policies, the UK can navigate the challenges posed by inflation.

As we navigate the intricacies of the UK’s inflationary landscape, it’s evident that a comprehensive approach is needed. Stay informed, adapt to changing conditions, and explore strategies that promote economic resilience. For further insights into the UK Inflationary Environment, visit this link.