Introduction:

In the unpredictable journey of life, preparing for unforeseen circumstances is essential. Establishing and nurturing Family Emergency Savings is a cornerstone of financial stability. In this article, we delve into the importance of such savings, the strategies for building them, and the peace of mind they provide during challenging times.

The Importance of Family Emergency Savings:

Family Emergency Savings serve as a financial safety net, providing a cushion against unexpected events such as medical emergencies, job loss, or unforeseen expenses. This financial preparedness not only shields the family from immediate crises but also fosters long-term financial resilience.

Link to “Family Emergency Savings” for Detailed Insights:

For comprehensive insights into the significance of Family Emergency Savings and practical tips for building them, visit keozanara.my.id. This resource offers valuable information to empower families in their journey toward financial security.

Building a Foundation:

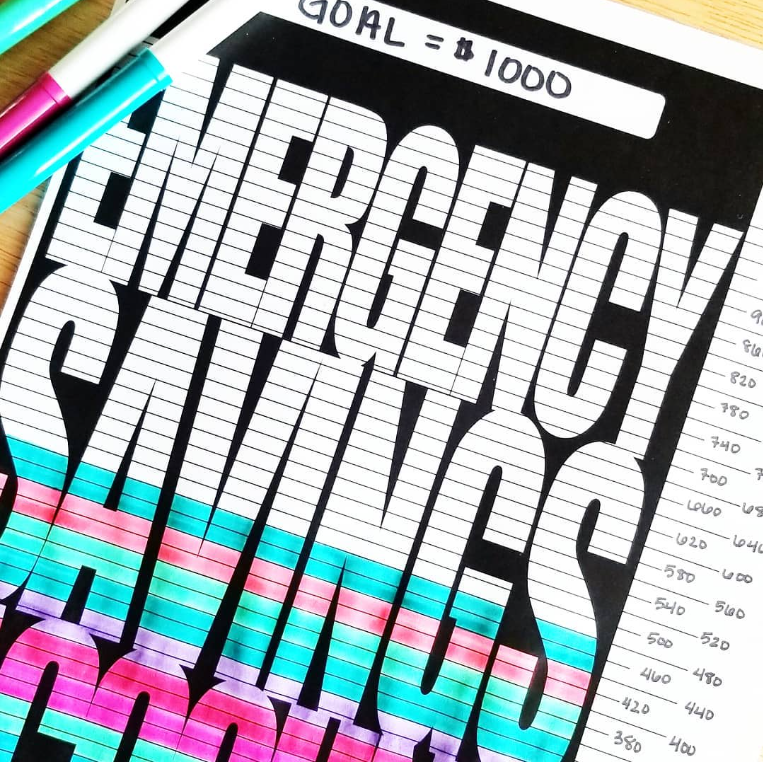

Initiating a Family Emergency Savings fund starts with setting realistic financial goals. Evaluate your family’s monthly expenses, consider potential emergencies, and establish a target savings amount. This foundation sets the stage for disciplined savings and a clear path toward achieving financial security.

Creating a Budget:

Building Family Emergency Savings requires a structured budget. Track your income and expenses, categorize spending, and identify areas where adjustments can be made. A well-planned budget not only aids in savings but also provides a holistic view of your financial landscape.

Automating Savings Contributions:

To ensure consistent contributions to your Family Emergency Savings, consider automating the process. Set up automatic transfers to your savings account on payday. This eliminates the need for manual transfers and cultivates a habit of regular savings, regardless of other financial commitments.

Emergency Savings vs. General Savings:

Distinguish between emergency savings and general savings. While general savings may be earmarked for planned expenses or future goals, emergency savings are reserved exclusively for unexpected crises. Having a clear differentiation helps in avoiding the unintentional depletion of emergency funds.

Investing Emergency Savings Wisely:

While accessibility is crucial for emergency savings, exploring low-risk investment options can optimize their growth. Consider money market accounts or short-term certificates of deposit (CDs) that offer higher interest rates than standard savings accounts while preserving liquidity.

Educating Family Members:

Inculcate a culture of financial responsibility within the family. Educate family members, including children, about the importance of emergency savings. By fostering an understanding of financial preparedness, you create a collective commitment to financial stability.

Handling Unexpected Expenses:

Despite diligent planning, unexpected expenses can arise. When utilizing Family Emergency Savings, do so judiciously. Prioritize genuine emergencies, such as medical bills or urgent home repairs, and avoid tapping into these savings for non-essential expenses.

Regularly Reviewing and Adjusting:

Financial landscapes evolve, and so should your savings strategy. Regularly review your Family Emergency Savings goals and adjust them based on changes in income, expenses, or family dynamics. This proactive approach ensures that your savings align with your current financial reality.

Conclusion:

Family Emergency Savings are not just a financial tool; they are a means of securing peace of mind. By diligently building and nurturing these savings, families empower themselves to face unexpected challenges without compromising their financial well-being. The journey towards financial security begins with a commitment to preparedness, and Family Emergency Savings are the cornerstone of that commitment.